Receba insights da Kinea exclusivos diretamente no seu e-mail.

Assine nossa newsletter.

The Dark Side of the Moon: The New Phase of the AI Race

Few albums in the history of music have achieved the status of a cultural icon like Pink Floyd’s “The Dark Side of the Moon”. Released in 1973, exploring universal themes such as time, money, and madness, it became a phenomenon and remained on the Billboard charts for an impressive 991 weeks, with over 45 million copies sold worldwide.

Critically acclaimed, the album brought Pink Floyd international fame and major accolades, including induction into the Grammy Hall of Fame in 1999. Its iconic prism on the cover, refracting light into a spectrum of colors, perfectly symbolizes the album’s concept: revealing the hidden spectra behind what we see.

Why do we use this famous album as an analogy for our Kinea Insights?

Just as “The Dark Side of the Moon” invites the listener to explore the dark and often overlooked side of the human experience, today we need to confront the “hidden side” of the Artificial Intelligence revolution.

In recent years, AI has been elevated to a transformative tool promising to revolutionize productivity, business, and society. Following the initial excitement around large language models, the current race and scale of investment are beginning to raise questions about the actual return on all that capital and the risk of a potential bubble.

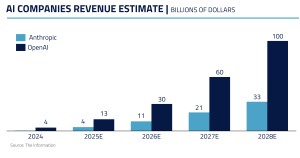

We have entered a new phase in which generic promises no longer suffice; investors and companies demand tangible results. With spending commitments exceeding $1 trillion over the coming years and revenues of only a few tens of billions, the sector will have to turn all the optimism built in recent years into reality.

This is happening in a context where many investors are already uneasy about the rise in indebtedness used to finance this technological race. This is the new challenge defining AI’s current phase: to demonstrate its economic value in a concrete and sustainable manner.

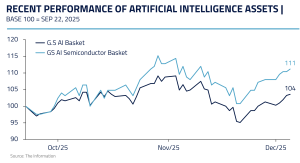

Despite the bubble narrative, Nasdaq is up a modest 22% year to date. The initial momentum has given way to a more sober reading of the fundamentals: the question is not the multiples at which these companies trade, but rather which of them will generate enough revenue growth to justify the sizable investments made so far.

Next, we will travel track by track through the “hidden side” of Artificial Intelligence, drawing a parallel with the songs on “The Dark Side of the Moon”. Just as on the album, where the listener is taken from the initial heartbeat to the final eclipse, we will move from AI’s early euphoria to the hard lessons now emerging—hoping, in the end, that from this testing phase a more solid and promising tomorrow will arise.

OPENAI AND THE MARKET’S QUESTIONING – “ON THE RUN”

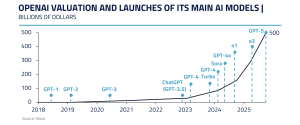

The track “On the Run” is a frenetic instrumental piece that portrays the anxiety of a high‑speed journey. In the AI universe, nothing better symbolizes this breakneck race than OpenAI, the company at the epicenter of this transformation.

In just a few years, OpenAI went from a relatively low‑profile lab to the most talked‑about name in the industry. Backed by billions of dollars in investments from partners such as Microsoft, it reshaped the AI race and, since the landmark launch of ChatGPT, set off a frenzied industry sprint for better models.

Recently, however, the pace of this journey has begun to stir anxiety in financial markets. OpenAI has committed to investing more than $1 trillion over the next five years—a colossal amount for a company whose annualized revenue to date barely reaches a few tens of billions of dollars.

Investors naturally ask: how will OpenAI make the numbers add up? Competing against giants such as Google, Meta, and xAI, as well as numerous well‑funded startups, will OpenAI be able to honor its contracts in such a competitive environment?

The hidden side here is that, despite the steady advancement of technology, tomorrow’s winners will not necessarily be today’s leaders. Oracle, for example, was hailed as the “AI darling” in September after announcing a cloud‑computing supply agreement of up to $300 billion with OpenAI. Since then, however, the gains have faded amid market doubts about OpenAI’s ability to fulfill that contract.

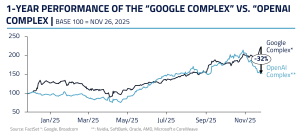

In parallel, many infrastructure companies linked to OpenAI also failed to sustain the pace of appreciation. Google, by contrast, has firmly established technological leadership and, just as OpenAI’s partners struggled over this period, Google’s partners posted strong gains.

OpenAI may disappoint in the short term, but it is unlikely to halt the broader advance of the technology. The AI journey continues “on the run,” perhaps with a few pilot changes along the way.

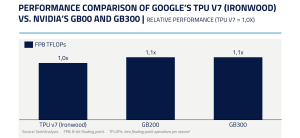

In this competitive landscape, it is important to note that Google’s recent competitive advantage was due, in part, to the efficiency of its TPU chips relative to Nvidia’s prior-generation Hopper chips.

However, as Nvidia’s new chips enter the training phase for the next wave of models—particularly those of OpenAI and xAI—we could see another reversal in the first quarter of next year. As the famous Mark Twain line goes, “reports of OpenAI’s death may have been greatly exaggerated.”

DO WE ALREADY HAVE A DECLARED WINNER? – “THE GREAT GIG IN THE SKY”

“The Great Gig in the Sky” is famous for Clare Torry’s ecstatic vocal solo. In the context of the AI race, an almost existential debate is emerging among investors: are we already seeing the outline of an “inevitable winner,” a player so powerful that the others are destined to be relegated to the background?

Many point to Google as this potential silent winner—the giant that, behind the scenes, may have accumulated structural advantages to lead the AI era—even though, until recently, it was regarded by many as a laggard.

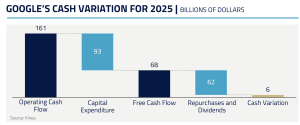

Indeed, the arguments in favor of Google are compelling. It is a company with one of the strongest balance sheets in the world, generating tens of billions in profit each quarter to reinvest at its discretion.

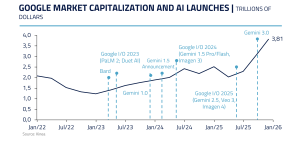

Google has been investing in AI for decades; it pioneered many of the techniques used today and arguably holds the largest data trove on the planet, given the breadth of its platforms—Search, YouTube, Gmail, Android, Maps, Drive, among others. All this data expands the possibilities for applying AI.

In addition, Google owns its own AI infrastructure: since 2015, it has developed TPUs (Tensor Processing Units), custom chips for artificial intelligence that already rival Nvidia’s GPUs; it is also one of the largest providers of cloud computing. In other words, Google combines state-of-the-art models trained on proprietary chips and data centers.

With its proprietary chips, Google sidesteps Nvidia’s high margins—reportedly as high as 80%, often referred to as the “Nvidia tax.” As a result, it can run chips with performance close to Nvidia’s at a computing cost that is 40% lower than companies relying exclusively on commercial GPUs.

Against this backdrop, some investors ask: has OpenAI—and other startups—already lost the race to Google, even at the outset of this investment cycle?

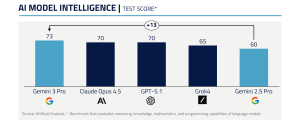

This perception intensified particularly after events such as the unveiling of Gemini 3, when many saw the potential to permanently surpass OpenAI’s models, coupled with a full ecosystem for monetization.

Our view here is cautious: we do not dispute that Google is a very strong contender to win this race; it truly combines unique attributes. However, we also believe the landscape is far from settled, we are dealing with an exploding market with extremely fluid developments.

For example, who would have said a year ago that a company like Anthropic would now be emerging as one of the favorites in enterprise generative AI applications?

GPT 5.2, released recently, also illustrates this scenario. Although it is a refinement of GPT‑4o through post-training, it has reached the top of the rankings. These examples show how quickly things change.

Pink Floyd’s “Great Gig in the Sky” conveys the notion of full surrender to the inevitable. In our parallel, however, nothing is inevitably handed to a single player yet. The AI sky has room for several stars to shine. Google may well be the brightest given its firepower, but it will not be the only one.

Google’s preeminence will be tested in the first quarter of next year with the first models trained on Nvidia’s Blackwell chips. If the scaling laws hold (more powerful chip clusters produce better models), we expect surprises when xAI and OpenAI unveil their new models.

Cloud Investments, Questionable Returns? – “Money”

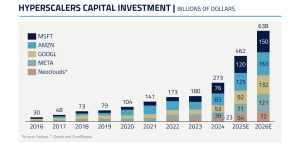

“Money, it’s a gas”—in this line from the classic hit “Money,” Pink Floyd lampoons the obsession with money. In the AI revolution, money (in the form of capital expenditures) is flowing as never before, funding a veritable digital “space race.”

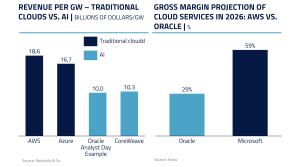

Given these figures, some market analysts have begun to ask: will this new AI‑driven cloud investment cycle generate commensurate returns?

In the first wave of cloud computing, Amazon, Microsoft, and Google invested in data centers and were amply rewarded with recurring revenue and robust services margins. Now, however, some argue that firms are merely renting GPUs as a commodity, without capturing profits from higher‑value services such as software.

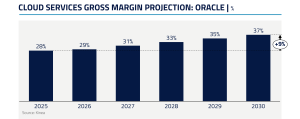

In our view, the strategy appears to be to offer raw AI capacity at competitive prices now and, later, capture value in the upper layers (databases and other software). Even with initially lower margins, scale and efficiency are expected to lift profitability. In addition, there is optionality and strategic positioning: treating AI as territory to be conquered, accepting lower near‑term returns to secure a foothold in a secular growth market.

In other words, the hidden side of the money being invested is a bet that the future will bring more AI use cases than we can imagine today, and that those who plant this infrastructure may reap more than meets the eye at first glance.

THE DILEMMA OF NVIDIA CHIPS’ USEFUL LIFE – “Time”

In the song “Time,” the clocks chime loudly, reminding us that time is relentless. In the AI world, an analogous concern has emerged: the useful life of Nvidia processors and how this is accounted for by companies.

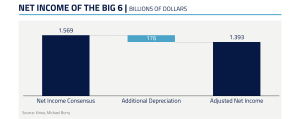

Michael Burry, an investor renowned for predicting the 2008 U.S. housing bubble, raised an uncomfortable question: are the technology giants overstating the useful life of their GPUs to extend the depreciation schedule and appear more profitable?

Broadly, Burry argues that the practical replacement cycle for GPUs is 2–3 years, rather than the 5–6 years used for accounting purposes. This effect would overstate hyperscalers’ earnings by roughly US$176 billion (13% of earnings) over 2026–28.

However, there is another side to this story. Nvidia states it has extended chip useful life through optimizations in its CUDA software stack. According to its Chief Financial Officer, A100 GPUs delivered six years ago are still running at full utilization, indicating that even with newer generations such as H100 and B200, chips from two generations back continue to run models profitably.

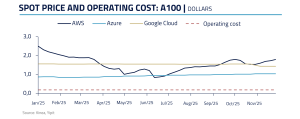

When we look at industry data, we find strong arguments in favor of the company. We continue to see A100 chips rented at rates above US$1 per hour, a level well above their estimated operating cost of US$0.20–0.30 per hour.

In other words, from an operational standpoint, all cards—both new and old—are functioning and generating revenue above their costs. From this perspective, there would be no malicious accounting manipulation, but rather a technological reality: chips do not become scrap as quickly as some had assumed; they find new uses and continue to contribute to profitable services.

The hidden side of time here is balancing the pressure to adopt cutting-edge technology (so as not to “miss the starting gun” of the next generation) with the discipline to extract maximum value from existing assets.

USE OF FINANCIAL LEVERAGE – “Us and Them”

On the track “Us and Them,” the lyrics juxtapose two sides in an almost theatrical way: “us” and “them,” two groups facing different perspectives.

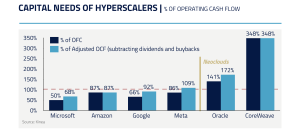

In the saga of AI investments, we also see two distinct sets of corporate strategies, each with its own risks and opportunities. On one side, companies are spending colossal amounts—often raising debt—to avoid falling behind in the AI race. On the other side, firms are investing more judiciously, deploying internal cash and pursuing clear monetization pathways.

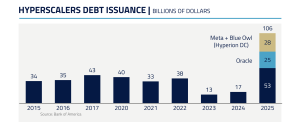

In recent months, it has become evident that the volume of investment and debt directed toward AI has reached unprecedented levels. Companies whose core business was not even AI have begun raising billions in debt to finance investments in this area.

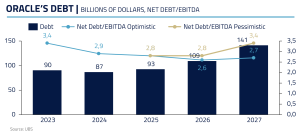

Oracle, a longstanding player in enterprise software and databases, has seen cloud AI as an opportunity for reinvention: it signed a mega-contract to provide infrastructure to OpenAI and began building large data centers. To finance this undertaking, it issued $18 billion in new debt in September and may need to raise up to an additional $100 billion in the coming years—significant leverage for a company of its size.

The market reacted with unease: Oracle’s CDS (credit default swaps), a proxy for default risk, surged to their highest level in two years, indicating a rise in the company’s perceived credit risk.

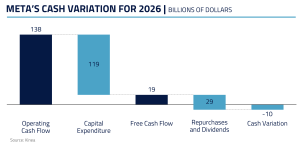

A similar case is Meta which, although highly profitable, determined it needed to invest heavily in AI and, as a result, is on track to deploy its entire cash generation.

The market did not welcome Meta’s investment plans. The company’s shares plunged 11% after guidance that investments will remain at elevated levels in 2026. A lingering perception took hold that Meta is overspending—a specter that also accompanied the metaverse.

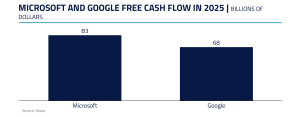

In contrast to these cases, Microsoft and Google are funding AI expansion with internally generated cash. Moreover, unlike Oracle and CoreWeave—both infrastructure providers—they benefit from unique distribution channels, which accelerate monetization.

From an investment standpoint, we view Microsoft and Google’s approach as more robust: using internal cash minimizes financial risk, and focusing on clear monetization provides greater confidence in the investment return outlook.

This does not mean Oracle, CoreWeave, or Meta are doomed. Should their visions materialize, they may regain investor confidence by delivering attractive returns on invested capital, though the current pressure is high and affords limited room for error.

CONCLUSION: A NEW PHASE IN THE AI SAGA – “ECLIPSE”

In the grand finale “Eclipse,” Pink Floyd ties all the album’s themes into a powerful climax, reminding us that all things, good or bad, are part of a whole (“and everything under the sun is in tune”), while also evoking how something radiant can be suddenly obscured (“the sun is eclipsed by the moon”). It is the conclusion that gives the record its title: even the brightest light has its dark side.

We appear to be living precisely an “Eclipse” moment in the journey of Artificial Intelligence. After a recent period filled with boundless hopes—when AI was celebrated almost like a rising sun that would illuminate every corner of the economy—we have reached a point where a shadow of questioning has begun to be cast.

Expectations have not vanished, but they have been temporarily dimmed by doubts and more concrete demands from investors. It is as if the romantic phase of innocence has ended. Now begins a phase of trial, of rigorous scrutiny—the dark side coming to the fore.

Companies that navigate this partial night will emerge stronger and more trustworthy in the eyes of the market. And once the eclipse has passed, the sun may shine again with full intensity—perhaps even brighter—reflecting AI responsibly and profitably integrated into the economy.

We are investing in the AI complex dynamically, always attentive to the challenges of the moment and to the greatest beneficiaries.

We remain at the disposal of our clients and partners.

Kinea Investimentos

Saiba onde investir nos fundos Kinea

Entre em contato e saiba como adquirir um de nossos fundos.